Being a new real estate investor is quite exciting, but it does bear many challenges. Deciding on purchasing an apartment building is a huge decision on its own. Many new investors get hung up on bad deals or suffer major financial consequences because of sudden decisions. Just like any industry, mastering the ins and outs is necessary to be successful in the apartment industry.

If you’re new to the world of investing in real estate and wish to buy an apartment building, you might want to consider these tips from seasoned brokers.

1. Analyze Your NOI (Net Operating Income)

The basis of the building being a good or bad investment is on how much money it makes compared to how much you paid for it, including the money you used. Brokers will put together a collective opinion of the income and expense, and come up with an NOI. It is called an “opinion” because it never really matches the owner’s actual statements.

Appraisers use the same methodology to anticipate how a usual owner handles the financial aspect of the building. Note that no two owners will match their NOI. Look at all the revenue and expenses and match them to the way you plan to run the said apartment building. Determine the sources of revenue that will be available and how full you want the building to be. Do you want it to be fully residential, or are you considering allotting some commercial space?

Think about other expenses, such as minor repairs or hiring third-party managers. Once all these things are cleared, you can evaluate your own NOI based on how you want it to run.

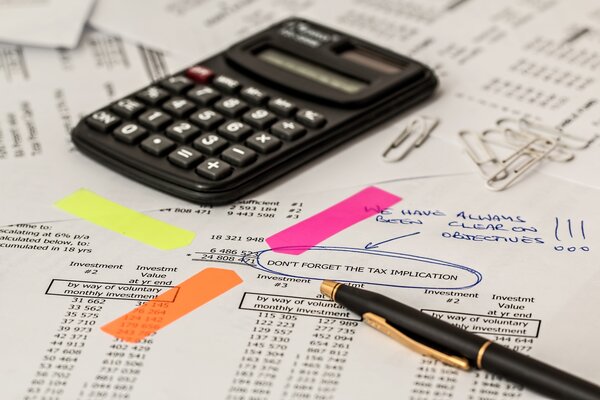

2. Learn About Your Area’s Property Tax Rules

Ask any realtor and they will tell you that taxes are the biggest expense on running a property. Each city, county, and state has a different methodology for calculating property taxes. These are based on how much the property was bought. Some are based on assessed valuations, which are calculated periodically.

Consult with a property tax lawyer who knows about the local market. This is a really important aspect, because any discrepancies with property taxes can result in losing all your investment.

3. Study the Building’s Physical Condition

This is a step that you should treat meticulously. Check every inch of the property, if you can. Even if you have experience in doing up places, it pays to seek the help of a plumber, electrician, and contractor to check if there are major issues to be addressed. Maintenance is one of the major expenses of any building owner, and if you’re not careful, your repair costs can be more than you can handle.

Check for electrical, plumbing, flooring, roof, window, and heating and cooling system issues, and evaluate things that you can anticipate. Additionally, check if the quality of the construction material passes the state standards.

4. Check If the Location Has Value

This one is almost a giveaway, but in real estate, a good location is top priority. Ideal locations for apartments have the following:

- Convenience to shopping and banking needs

- Easy access to transportation

- Proximity to major employment hubs

In some cases, a location has more value if it doesn’t have any close buildings nearby.

Conclusion

Learning the ins and outs of apartment buildings is necessary for you to make a sound purchase. Don’t jump into deals quickly. Always double-check (or triple-check) the things that fall under these four factors before signing anything.

Are you an apartment building buyer? Buying Apartment Buildings can help your search on finding the best building to purchase. Whether you’re looking to buy, lease, rent, or sell, our updated database will provide you with quality leads.